Insight on LiDAR Industry Chain

Author: Release time:2021-03-18 02:31:07

LiDAR is a sensor that uses lasers to achieve precise ranging. In a broad sense, it can be regarded as a camera with 3D depth information and is known as the “eyes of a robot”. Since its birth, the LiDAR industry has been closely keeping in step with the cutting-edge development of underlying devices and has shown outstanding features of high technological levels. With the continuous development towards chip and array in recent years, LiDAR has always been a representative of the development and application of emerging technologies from the single-point LiDAR at the beginning of the invention of lasers to the later single-line scanning LiDAR, to the multi-line scanning LiDAR which has been widely recognized in unmanned driving technology, to the solid-state LiDAR and FMCW LiDAR with continuous innovation in technical solutions.

According to statistics and forecasts from Frost & Sullivan, the global LiDAR market will reach USD 13.54 billion by 2025, a compound annual growth rate of 64.5% compared to 2019. By 2025, China’s LiDAR market will reach 4.31 billion U.S. dollars, achieving a compound annual growth rate of 63.1% compared to 2019.

LiDAR Industry Chain

From the perspective of the industry chain, the link where the LiDAR is located has accumulated a lot of value and has a strong industrial added value.

As an emerging radar technology with high popularity in recent years, LiDAR technology has a sophisticated and complex system structure, requires sensitive and precise equipment design, and high-precision machinery and equipment during the production process; also pays attention to a high degree of cooperation in multi-modules work and operation. Under such high standard specifications, there are great technical barriers for the production and R&D of LiDAR to enter the enterprise, and the initial investment will not achieve notable results.

LiDAR is the core component of downstream navigation, mapping, and other applications. The current scarcity of production capacity leads to short supply, resulting in a seller’s market so that LiDAR has strong pricing power against downstream industries. Therefore, the main added value of the industry chain lies in the LiDAR part, and the overall profitability of the industry is relatively large.

LiDAR has driven competition in related industry chains. At present, the core components of LiDAR include lasers (such as solid-state lasers, semiconductor lasers, gas lasers, etc.), scanners (such as scanning mirrors, rotating motors, etc.), and photoelectric detectors (such as SiPM, APD, CCD/CIS, etc.) and receiver IC (such as amplifiers, analog-to-digital converters, FPGA, etc.), location and navigation system (GPS, IMU). Among them, the leading component suppliers are mainly from Europe and the United States.

LiDAR Upstream

The upstream mainly includes four parts: laser emission, laser reception, scanning system, and information processing. A large number of optical and electronic components in these four parts form the basis of LiDAR.

The upstream core component manufacturers, no matter optical components or electronic components, those involving the processing and manufacturing of precision instruments and chips are currently basically monopolized by large manufacturers from Europe and the United States.

Besides, the LiDAR chips in the Chinese market, especially the components required for signal processing, are mainly dependent on imports, which has raised the production cost of LiDAR to a certain extent. Therefore, many Chinese chip companies are striving to fill the gap in this field in the Chinese market through their advantageous technologies.

LiDAR Midstream

The LiDAR midstream can be divided into two categories: automotive LiDAR and logistics transportation LiDAR.

LiDAR applications are currently one of the fastest-growing industries in the automotive industry. In terms of shipments, Yole predicts global LiDAR shipments to be approximately 23.9 million in 2030.

There are many suppliers of automotive LiDAR, including Neuvition, Velodyne LiDAR, Vales, Ibeo, Continental, etc. Manufacturers of industrial and logistics transportation LiDAR include SICK, Hokuyo, OMRON, Velodyne LiDAR, Konica Minolta, etc.

LiDAR Downstream

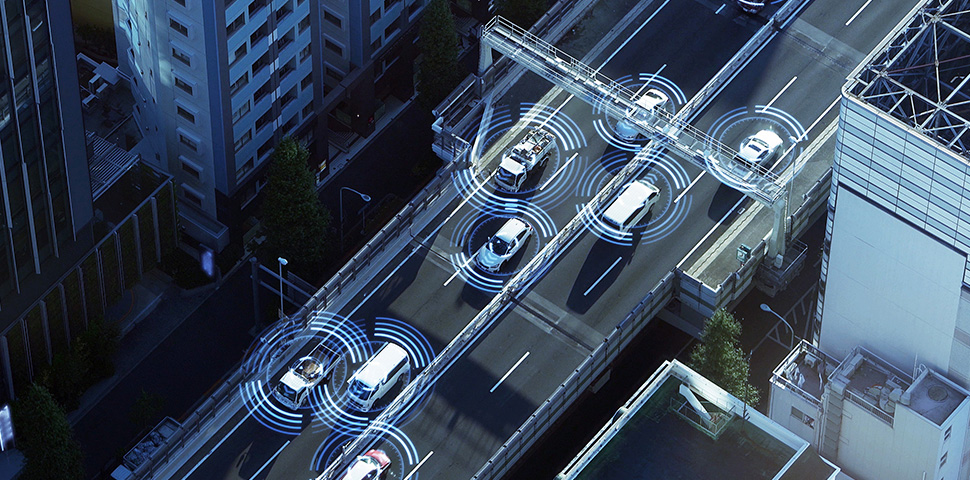

LiDAR has a wide range of downstream applications, mainly divided into autonomous driving industry, ADAS industry, service robot industry, V2X/CVIS industry, etc.

LiDAR is the key to the realization of self-driving technology. Compared with millimeter-wave radar and ultrasonic radar, it has the highest measurement accuracy, fast response speed, and absolute advantages in operation performance. The implementation of self-driving services depends on the high-precision sensing information provided by LiDAR. Moreover, the environmental perception capability of LiDAR can expand existing assisted driving functions, improve vehicle safety, and provide significant support for the advanced assisted driving industry for OEMs and Tier1.

Although LiDAR is not as widely-used as ultrasonic radar and millimeter-wave radar in L2 and L3 cars, most automakers and Tier1 believe that LiDAR will become a must-have sensor for autonomous vehicles above L3, and will eventually become the core sensor for autonomous vehicles above L4.

At the same time, LiDAR technology has also promoted the rise of the service-oriented robot industry and the V2X industry. Service robots can realize unmanned distribution and unmanned cleaning functions by giving robots the ability to perceive intelligently. Through the interconnection among cars-cars, cars-roads, and cars-cloud platforms, etc., V2X internet can achieve safer, more comfortable, and intelligent transportation services.

LiDAR global competition: led by European and American manufacturers, Chinese LiDAR market blossoms

The global market for LiDAR has gradually opened up in recent years. European and American manufacturers have advantages in the upstream and midstream, leading in technology and customer base. European and American countries have tried to apply LiDAR technology in ADAS-assisted obstacle avoidance and navigation projects as early as 2010.

As a representative of the core sensors for autonomous driving in the future, the core technology of LiDAR is mainly controlled by three European and American companies: Luminar, Velodyne, and Ibeo.

Luminar is the global leader in automotive LiDAR hardware and software technology. It is not currently the largest market share of LiDAR. Velodyne currently has the largest market share, but Luminar has already been recognized by mainstream automakers. Luminar has obtained a total of 50 business partners in vertical industries such as passenger cars, trucks, and automated taxis, accounting for approximately 75% of the major players in the target customer ecosystem.

American Velodyne was founded in 1983. Its mechanical LiDAR started early and its technology is leading. At the same time, it has established cooperative relationships with global leaders in autonomous driving such as Google, General Motors, Ford, Uber, Baidu, etc., occupying most of the LiDAR market share.

Founded in 1998, Ibeo is the first company in the world to have a car-grade LiDAR. In 2017, it launched an all-solid-state LiDAR A-Sample prototype.

Chinese LiDAR Market

After the wave of autonomous driving in recent years, Chinese LiDAR manufacturers have gradually entered the game. Autonomous driving in China is divided into two genres. One focuses on the research and development of mechanical LiDAR similar to the technology route of Velodyne and other traditional counterparts, and the other is directly targeting solid-state LiDAR products. The goal is to enter the pre-installation market after 2020.

Chinese LiDAR companies such as RoboSense, Hesai Technology, SureStar, and Leishen Intelligent have emerged one after another. The competition in the Chinese market is fierce and the market is full of flowers.

With the gradual mass production for L3 self-driving passenger cars from 2020, the market’s demand for auto-grade solid-state LiDAR will usher in a small climax. Consumer electronics hardware giants such as DJI and Huawei have successively released their new LiDAR products, to directly join the battle of pre-installation mass production vehicles.

In August 2020, DJI announced its first auto-driving LiDAR price has been reduced to 1,000 yuan, and mass production is sure. Livox Technology, a LiDAR brand under DJI, also released two high-performance LiDAR sensors at CES in the United States.

Conclusion:

The future LiDAR technology is mainly based on the principles of ToF and FMCW. For LiDAR based on the ToF principle, the chip-based LiDAR is the future development direction. The transmitting end gradually adopts planar laser devices, and the receiving end gradually adopts single-photon detectors based on CMOS technology. FMCW LiDAR based on silicon optical chips is a major trend in future development.

The development of LiDAR will promote the development of self-driving technology and ADAS in the automotive industry, and will also expand the application scope and increase the popularity of service robots. In the future, with the further popularization of autonomous driving technology, the scale of the LiDAR market will further expand, and the decline in the value of bicycles will further facilitate the mass production and use of LiDAR.

With the gradual popularization of artificial intelligence and 5G technologies, driven by demand for auto driving, ADAS, service robots, and V2X, the overall LiDAR market is expected to show a rapid development trend.